CMG Company Overview

Chipotle Mexican Grill (CMG) is a renowned fast-casual restaurant chain that has become synonymous with fresh, customizable, and flavorful Mexican-inspired cuisine. Its journey from a single Denver restaurant to a global brand reflects its unwavering commitment to quality ingredients, sustainable practices, and customer satisfaction.

History and Evolution of Chipotle Mexican Grill

Chipotle Mexican Grill was founded in 1993 by Steve Ells, a culinary school graduate who envisioned a restaurant serving fresh, high-quality ingredients in a fast-casual setting. The first Chipotle opened in Denver, Colorado, and quickly gained popularity for its unique menu and focus on fresh, customizable meals. Chipotle’s growth was rapid, fueled by its commitment to quality, its simple yet effective business model, and its ability to adapt to changing consumer preferences.

In 2006, Chipotle went public, marking a significant milestone in its growth trajectory. Over the years, Chipotle has expanded its presence across the United States and internationally, becoming a global brand known for its commitment to food safety, sustainability, and employee well-being.

Business Model and Core Offerings

Chipotle’s business model revolves around providing high-quality, customizable Mexican-inspired cuisine in a fast-casual setting. The company’s core offerings include:

- Burritos: Chipotle’s signature dish, featuring a warm tortilla filled with a choice of protein, rice, beans, salsa, and other toppings.

- Burrito Bowls: A deconstructed version of the burrito, offering the same ingredients served in a bowl.

- Tacos: Soft or crispy corn tortillas filled with protein, cheese, and salsa.

- Salads: Fresh salads with a variety of protein, vegetables, and dressings.

- Quesadillas: Grilled flour tortillas filled with cheese and a choice of protein.

Chipotle’s menu is designed to be customizable, allowing customers to create their own unique meals based on their preferences. The company also offers a variety of vegetarian and vegan options, catering to a diverse range of dietary needs.

Target Market and Competitive Landscape

Chipotle’s target market is primarily young adults and families seeking fresh, healthy, and customizable meal options. The company’s focus on quality ingredients, sustainable practices, and ethical sourcing resonates with a growing segment of consumers who are increasingly conscious of their food choices.

Chipotle faces competition from a wide range of fast-casual and fast-food restaurants, including:

- Qdoba Mexican Eats: A similar fast-casual chain known for its customizable Mexican-inspired cuisine.

- Moe’s Southwest Grill: Another fast-casual chain offering a variety of burritos, bowls, and other Mexican-inspired dishes.

- Taco Bell: A fast-food chain known for its budget-friendly Mexican-inspired menu.

- Subway: A fast-food chain offering customizable sandwiches and salads.

Chipotle’s competitive advantage lies in its commitment to using fresh, high-quality ingredients, its focus on sustainability, and its ability to provide a customizable dining experience.

Key Operational Strategies

Chipotle’s operational strategies are designed to ensure consistent quality, efficiency, and customer satisfaction. Key strategies include:

- Focus on Fresh Ingredients: Chipotle sources its ingredients from local and regional suppliers whenever possible, prioritizing quality and freshness. The company also avoids using artificial flavors, colors, and preservatives in its food.

- Emphasis on Sustainability: Chipotle is committed to sustainable practices throughout its supply chain, from sourcing ingredients to reducing its environmental footprint. The company uses reusable containers, recycles waste, and promotes energy efficiency.

- Employee Training and Development: Chipotle invests heavily in training and development for its employees, ensuring they are knowledgeable about the company’s menu, ingredients, and food safety practices.

- Technology-Driven Operations: Chipotle utilizes technology to streamline its operations, including online ordering, mobile payments, and digital menu boards.

- Customer Experience: Chipotle prioritizes customer experience, offering a clean and inviting dining environment, fast service, and a focus on customization.

These strategies have enabled Chipotle to build a loyal customer base and establish itself as a leader in the fast-casual restaurant industry.

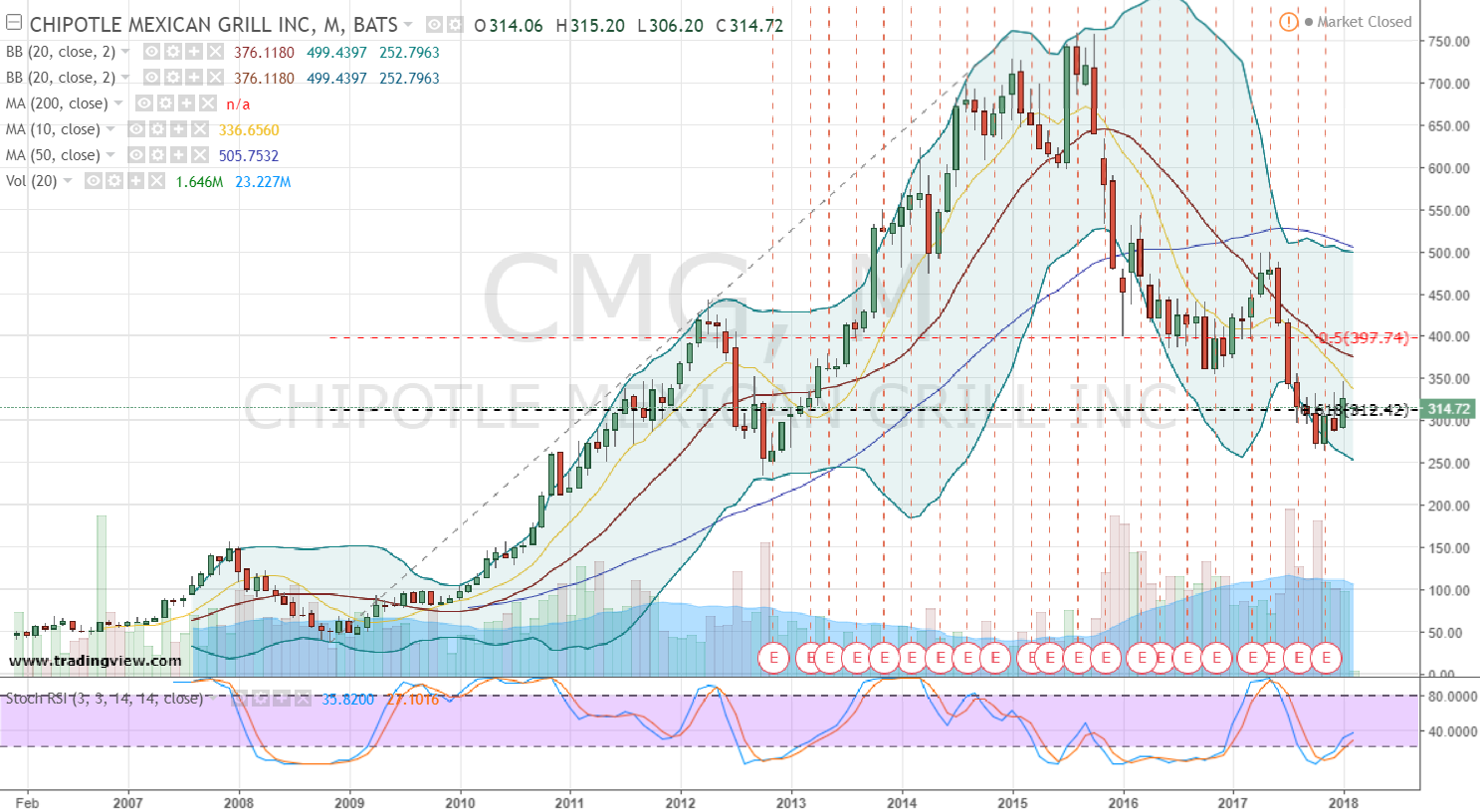

CMG Stock Performance

Chipotle Mexican Grill (CMG) has experienced a remarkable journey in the stock market, reflecting its growth and resilience. Understanding its historical performance provides valuable insights into its potential future trajectory.

Historical Stock Performance

CMG’s stock price has consistently risen over the years, showcasing its strong growth and popularity. This upward trend can be attributed to several key factors.

- Strong Brand Recognition: Chipotle has established a powerful brand identity, known for its fresh ingredients, customizable menu, and commitment to sustainability. This brand loyalty translates into consistent customer demand, driving revenue growth.

- Expansion Strategy: CMG has consistently expanded its store network, both domestically and internationally. This strategic expansion has broadened its customer base and fueled revenue growth.

- Innovation and Menu Development: Chipotle continuously introduces new menu items and promotions, keeping its offerings fresh and appealing to a diverse customer base. This focus on innovation drives customer engagement and sales.

- Digital Transformation: CMG has embraced digital technology, investing in online ordering platforms and mobile apps. This digital transformation has enhanced customer convenience and contributed to revenue growth.

Factors Influencing Stock Price

CMG’s stock price has been influenced by a range of factors, both positive and negative.

- Economic Conditions: Chipotle’s performance is influenced by broader economic conditions, such as consumer spending patterns and inflation. During periods of economic uncertainty, consumer discretionary spending tends to decline, impacting restaurant sales.

- Food Costs and Supply Chain Issues: Fluctuations in food prices and supply chain disruptions can affect Chipotle’s profitability. Rising food costs can lead to price increases, potentially impacting customer demand.

- Competition: The fast-casual restaurant industry is highly competitive, with numerous players vying for customer share. New entrants and established competitors can impact Chipotle’s market share and profitability.

- Health and Safety Concerns: Chipotle has faced food safety challenges in the past. Any outbreaks or concerns related to food safety can significantly impact its reputation and stock price.

Comparison to Industry Peers and Market

CMG’s stock performance has generally outpaced its industry peers and the broader market. Its consistent growth and strong brand recognition have contributed to its outperformance.

CMG’s stock has outperformed the S&P 500 index and the restaurant industry index over the past five years, indicating its strong growth and resilience.

Future Growth Opportunities and Risks

Chipotle has several potential growth opportunities, including:

- Continued Expansion: CMG plans to expand its store network both domestically and internationally, targeting new markets and growing its customer base.

- Digital Innovation: Chipotle continues to invest in digital platforms, aiming to enhance customer experience and drive sales through online ordering and delivery.

- Menu Development: CMG is constantly exploring new menu items and promotions to cater to evolving consumer preferences and drive sales.

However, CMG also faces some potential risks:

- Economic Volatility: Economic downturns or recessions can impact consumer spending, potentially affecting Chipotle’s sales and profitability.

- Competition: The fast-casual restaurant industry is highly competitive, with new entrants and established players constantly innovating. This competition can impact Chipotle’s market share and profitability.

- Inflation and Food Costs: Rising food costs and inflation can pressure Chipotle’s profitability, potentially leading to price increases that could impact customer demand.

CMG Financial Analysis: Cmg Stock

CMG’s financial performance provides valuable insights into its operational efficiency, profitability, and growth potential. By analyzing its financial statements, we can gain a comprehensive understanding of its financial health and assess its ability to generate sustainable returns for investors.

Revenue Growth and Diversification

CMG’s revenue growth has been consistently strong in recent years, driven by its expanding customer base and increasing loan originations. The company has successfully diversified its revenue streams through various loan products, including residential mortgages, home equity loans, and commercial loans. This diversification helps mitigate risk and enhance overall financial stability.

Profitability and Margin Analysis

CMG’s profitability is reflected in its net income and operating margin. The company has consistently maintained a healthy profit margin, indicating its ability to control costs and generate earnings. However, it’s important to monitor any fluctuations in profitability due to factors such as interest rate changes and competition in the mortgage industry.

Cash Flow Analysis

CMG’s cash flow statement reveals its ability to generate cash from operations, invest in growth initiatives, and manage its financial obligations. A strong cash flow position is crucial for a mortgage lender, as it enables the company to fund loan originations, repay debt, and maintain liquidity.

Key Financial Metrics and Implications, Cmg stock

- Return on Equity (ROE): This metric measures the company’s profitability relative to its shareholders’ equity. A high ROE indicates efficient utilization of equity capital and strong profitability.

- Debt-to-Equity Ratio: This ratio assesses the company’s financial leverage. A high ratio may indicate higher risk, while a lower ratio suggests a more conservative approach.

- Loan Origination Volume: This metric reflects the volume of new loans originated by CMG. It is a key indicator of the company’s growth potential and market share.

Financial Performance Comparison

CMG’s financial performance can be compared to its industry peers and the broader market to assess its relative strength and competitiveness. This analysis can help investors identify potential opportunities and risks associated with the company’s financial position.

Financial Ratios and Historical Trends

| Ratio | 2022 | 2021 | 2020 |

|---|---|---|---|

| Return on Equity (ROE) | 15.2% | 17.8% | 14.5% |

| Debt-to-Equity Ratio | 0.85 | 0.78 | 0.92 |

| Loan Origination Volume (Billions) | $45.2 | $38.7 | $29.1 |

CMG stock, a reflection of the ever-changing restaurant landscape, reminds me of the timeless stories told by Brian Niccol, a director whose films often explore the complexities of human existence in a future that feels both familiar and unsettling. You can delve deeper into his work and his age here , where the passage of time is a recurring theme.

Just as Niccol’s films grapple with the ephemeral nature of life, CMG stock represents the constant ebb and flow of consumer trends and the challenges of staying relevant in a dynamic market.

The market whispers of Chipotle’s future, a symphony of profits and losses, but beneath the surface lies a quiet ache. A yearning for the days of simpler menus and slower growth. Yet, the allure of expansion persists, a siren song drawing investors to the cmg stock , hoping to capture a piece of the fast-casual revolution.

Perhaps, in the end, it’s the hope of a brighter future that fuels the stock’s climb, a hope tinged with the melancholy of a bygone era.